Prices have taken a dip from their 52-week highs. Time to reevaluate your strategy or spot potential buying opportunities? Stay informed and invest wisely! 💼📊 #StockMarket #Investing #MarketTrends #OpportunityAwaits

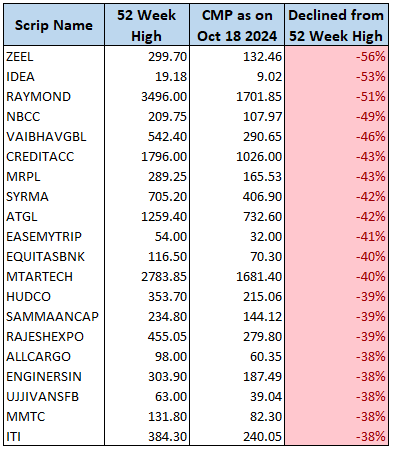

The data shows a sharp decline in 20 Nifty-500 Stock prices from their respective 52-week highs as of October 18, 2024. This analysis provides a clear picture of the bearish trends affecting multiple stocks, with declines ranging from 38% to as high as 56%.

Notable Declines

- ZEEL (-56%): Leading the list with the steepest decline, Zee Entertainment Enterprises Limited (ZEEL) saw a massive drop of 56% from its 52-week high of ₹299.70, currently trading at ₹132.46.

- IDEA (-53%): Vodafone Idea has faced a tough time, with its stock price cut in half, declining by 53%. This major drop brings it down to ₹9.02 from its 52-week high of ₹19.18.

- RAYMOND (-51%): The textile and apparel company Raymond saw its stock plummet by 51%, from ₹3496.00 to ₹1701.85. PS : (Raymond’s shares trading at a value excluding the lifestyle business.)

Significant Drops Between 40%-50%

Several companies experienced declines between 40% and 50%, reflecting widespread volatility:

- NBCC (-49%): National Buildings Construction Corporation (NBCC) shares fell by 49%, down from ₹209.75 to ₹107.97.

- VAIBHAVGBL (-46%): Vaibhav Global, a jewelry and lifestyle products retailer, saw its stock drop by 46%, now at ₹290.65.

- CREDITACC (-43%): CreditAccess Grameen witnessed a 43% decline, bringing its price down from ₹1796.00 to ₹1026.00.

- MRPL (-43%): Mangalore Refinery and Petrochemicals Ltd shares dropped by 43% from ₹289.25 to ₹165.53.

- SYRMA (-42%): Syrma SGS Technology fell by 42%, with its price declining from ₹705.20 to ₹406.90.

- ATGL (-42%): Adani Total Gas also saw a sharp 42% decline, with the stock now at ₹732.60.

- EASEMYTRIP (-41%): EaseMyTrip shares have dropped by 41%, trading now at ₹32.00 from a high of ₹54.00.

- EQUITASBNK (-40%): Equitas Small Finance Bank dropped by 40%, with its current price at ₹70.30.

- MTARTECH (-40%): MTAR Technologies also saw a 40% decline from ₹2783.85 to ₹1681.40.

- HUDCO (-39%): Housing and Urban Development Corporation Limited (HUDCO) has experienced a 39% decline, now priced at ₹215.06.

- SAMMAANCAP (-39%): Samvardhana Motherson has fallen by 39%, with shares down to ₹144.12.

- RAJESHEXPO (-39%): Rajesh Exports also saw a 39% decline in its stock value, currently trading at ₹279.80.

- ALLCARGO (-38%): Allcargo Logistics has dropped 38%, from ₹98.00 to ₹60.35.

- ENGINERSIN (-38%): Engineers India Limited saw its stock price drop to ₹187.49, a 38% decline.

- UJJIVANSFB (-38%): Ujjivan Small Finance Bank shares dropped to ₹39.04 from ₹63.00.

- MMTC (-38%): MMTC Limited, a state-owned trading company, saw its price fall by 38%, now trading at ₹82.30.

- ITI (-38%): ITI Limited, an Indian telecommunications equipment manufacturer, saw a decline of 38%, with its price currently at ₹240.05.

Conclusion

The data presented in above table paints a clear picture of the significant downturn among select Nifty 500 stocks, with sharp declines from their 52-week highs, ranging from 38% to 56%. This suggests growing market volatility and investor caution, driven by both global and sector-specific challenges. However, for strategic investors, these drops may offer opportunities to capitalize on undervalued stocks with strong fundamentals.

While the current market environment remains uncertain, investors should exercise due diligence and risk management. This analysis offers valuable insights, helping investors make informed decisions about rebalancing their portfolios, identifying potential buy-in opportunities, and navigating through these volatile market conditions.